North American

Secure HorizonSM Choice

Strengthen your growth potential

North American Secure HorizonSM Choice fixed index annuity (Secure Horizon Choice) can help you confidently take control of your financial future. Secure Horizon Choice offers protection, an enhanced opportunity for growth, and tax deferral.

Helpful resources

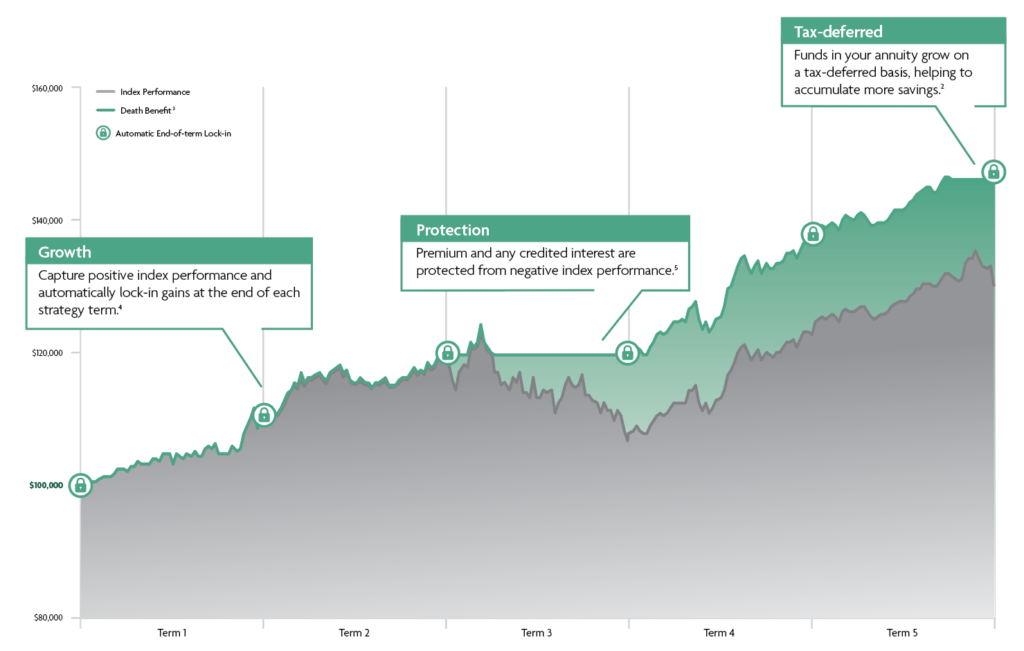

Growth

Premium can increase in value based on the positive performance of one or more indices.

Protection

Premium and an interest earnings are 100% protected from market downturns.1

Tax-deferral2

You’ll pay no current income tax on interest earnings, which can help you accumulate more assets.

Premium Protected Growth Opportunity

Secure Horizon Choice can help take your retirement savings to the next level while protecting your hard-earned money from market risk. Your annuity has the potential to grow based on the performance of an underlying index and stay protected with a lock-in feature that applies no matter which crediting method you choose. With the lock-in feature, any interest credits are added to your accumulation value at the end of each strategy term.5 Your annuity will also grow tax-deferred, meaning you won’t have to pay taxes on any growth until you make a withdrawal.

Hypothetical Assumptions: This hypothetical example is not based on any particular Secure Horizon Choice product or index. It is intended for educational purposes only and is not a projection or prediction of future performance; your experience will differ. $100,000 purchase payment, 100% Participation Rate, 0% Strategy Charge.

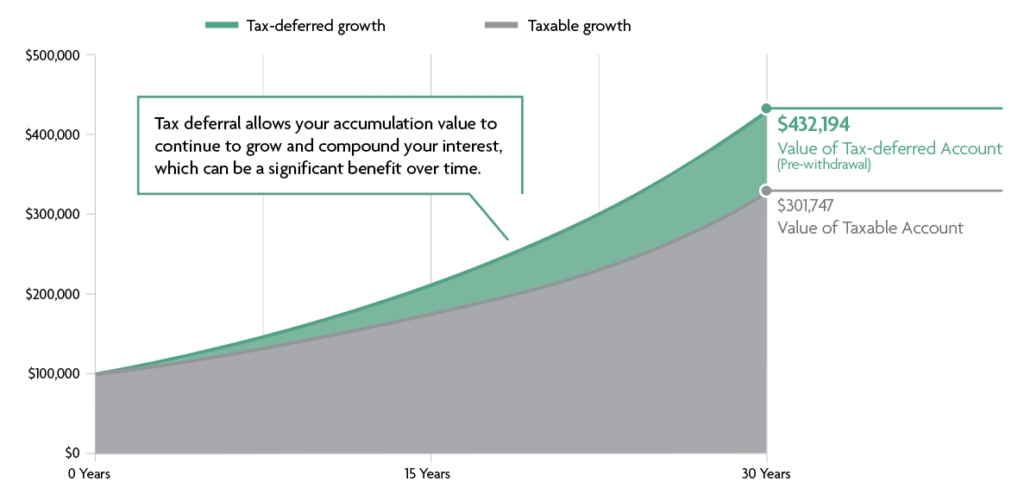

Benefit from tax deferral

Secure Horizon Choice grows on a tax-deferred basis, meaning you won’t owe current income taxes until you access your accumulation value. This allows more of your assets to continue to grow and compound over time.

This hypothetical example is not based on any particular product or index. It is intended for educational purposes only and is not a projection or prediction of future performance; your experience will differ. Example assumes $100,000 growing at 5%, 25% tax bracket for 30 years.

Discover the comprehensive index options available with the Secure Horizon Choice FIA Suite.

1 Although fixed index annuities guarantee no loss of premium due to market downturns, deductions from your accumulation value for Strategy Charges or optional rider charges could exceed interest credited to the accumulation value, which would result in an overall reduction of premium.

2 Under current law, annuities grow tax deferred. An annuity is not required for tax deferral in qualified plans. Annuities may be subject to taxation during the income or withdrawal phase. Neither North American Company for Life and Health Insurance, nor any financial professionals acting on its behalf, should be viewed as providing legal, tax or investment advice. You should rely on your own qualified tax professional.

3 When the contract Death Benefit is paid, a pro-rata interest credit will be applied to the accumulation value. The Death Benefit may be reduced for premium taxes at death as required by the state of residence.

4 Growth opportunity may be limited by Strategy Charges, Participation Rates below 100% and/or cap rates.

5 Deductions from your accumulation value for Strategy Charges could exceed interest credited to the accumulation value, which would result in loss of premium or prior interest credits.

Fixed index annuities are not a direct investment in the stock market. They are long-term insurance products with guarantees backed by the issuing company. They provide the potential for interest to be credited based in part on the performance of specific indices, without the risk of loss of premium due to market downturns or fluctuation. Although fixed index annuities guarantee no loss of premium due to market downturns, deductions from your accumulation value for additional optional benefit riders or strategy fees or charges associated with allocations to enhanced crediting methods could exceed interest credited to the accumulation value, which would result in loss of premium. They may not be appropriate for all clients. Interest credits to a fixed index annuity will not mirror the actual performance of the relevant index.

Annexus and their affiliated agencies are independently contracted with North American Company for Life and Health Insurance.

North American Secure HorizonSM Choice is issued on base contract form NA1015A/ICC21-NA1015A or appropriate state variation including all applicable endorsements and riders by North American Company for Life and Health Insurance, West Des Moines, IA. This product, its features and riders may not be available in all states.

Sammons Financial® is the marketing name for Sammons® Financial Group, Inc.’s member companies, including North American Company for Life and Health Insurance®. Annuities and life insurance are issued by, and product guarantees are solely the responsibility of, North American Company for Life and Health Insurance.

35866Z

REV 2-24